Why I do not have a 401(k)

- Iustin Rosioara

- Jan 30, 2022

- 16 min read

Before explaining the reasons why I decided to not have a 401(k), I have to clarify a couple things.

While many talk about the concept of ‘saving for retirement’ and consider it to be a good idea, I consider it to be a bad one, and I even wonder if it is marketed with the purpose to mislead the general public. The whole concept is based on the principle that, during a working lifetime, people should put aside a certain share of their income in an ‘egg nest’, let it grow over time without much, if any at all, personal supervision and oversight (aka ‘passive investments’) and then, at the time of retirement, start taking periodical distributions out of that egg nest so one can supplement the income that Social Security hopefully will still provide.

I think this is a bad concept because it builds on constraints at both ends. First, it constrains a person to give away a part of the income during the working years and then, when the time comes, there is a limit to how much a person can take out of that nest egg, to make sure that it lasts for the rest of the life and it doesn’t dry out too early.

Having said that, I definitely support two concepts:

- Planning for retirement – meaning to have a clear strategy to make sure there is a significant income after retirement age and,

- Investing for retirement – meaning the portfolio of investments made during working time produce a constant and perpetual cash flow, without depleting or tapping into that portfolio.

In order to achieve these goals, the 401(k) is not the way to go, and in this blogpost I will explain why.

#1. It is a tax deferred system, not a tax exempt one

Many believe that 401(k) investments offer some form of tax exemption, either during the time of contributions or in the future, when funds are withdrawn. For most 401(k) programs, this is not the case.

The traditional 401(k) systems are ‘tax deferred’. That means that any contribution to a 401(k) is not subject to taxation at the time of contribution, but any distribution taken out after retirement age will be taxed as regular income. In other words, the fact that the tax burden is reduced may feel like a relief during the working years, but it will surely come back as an additional tax liability when distributions are added to the income.

The logical consequence is that a tax deferred system is advantageous for those who expect to make less money in the future than they are making now. The nature of the taxation system in the US and most developed countries, with progressive tax rates, will make it disadvantageous to defer taxes for someone who expects to have increased income in the future.

A commitment to a tax deferred program exposes you to at least two risk factors:

a) Increased tax risk due to political factors.

The history shows that politicians, regardless of their orientation and how much they talk about it, never take any action to reduce the overall tax charge. Therefore, there is very little chance for the tax rates to be lowered, but there is always an increased chance for the tax rates to be raised.

b) Overall loss due to inflation

Inflation is probably the most present and the least understood phenomenon in modern economic times. The lack of understanding is mainly caused by excessive focus on ‘nominal’ numbers, like nominal growth, nominal rates etc.

Individual incomes, business revenues and asset evaluations are all expressed in nominal terms and there is little attention paid to the loss of purchasing power over time of the currencies used to express those incomes, revenues and evaluations. The consequence is that, while many portfolios show nominal increases, a significant part of those increases are caused by inflation, or the rate of depreciation of the currency.

Using an example, a $100,000 portfolio increasing at a rate of 7% per year will be evaluated, after 30 years, at over $800,000. This sounds like a significant gain. Still, if the inflation rate is also equivalent to 7%, that means that the purchasing power of the $800,000 is equivalent to the purchasing power of $100,000 initially in the portfolio.

A similar example - family gatherings, where different generations come together, offer the opportunity to compare the prices of groceries. Nowadays, filling a shopping cart requires somewhere between $120 and $150, while the same could be done with $20 just a couple decades ago. Similar exercises can be done for other consumables, durable goods, cars, and homes, all showing similar results.

While the nominal numbers are higher but there is no equivalent increase in the purchasing power, it means that all taxes paid on the distribution taken out of the 401(k) portfolio during retirement are in fact taxes paid on inflation. What does it mean when you pay tax on an income that does not reflect any real gain or increased purchasing power? It means, you have no benefit. In fact, if you factor in the tax, you are able to buy less. Paying taxes on a gain that brings no benefit is a bad proposition, because it is a loss. And the loss is even greater if the amount that you take out yearly is large enough to place you into a higher tax bracket.

For me, who expect (by the Grace of God) to experience constantly increasing income over the years, deferring taxes is definitely not the way to go, and this is the first reasons I do not have a 401(k).

For accuracy, I have to mention that there are some 401(k) plans that are not tax deferred. Known as ‘Roth 401(k)’ plans, the contributions are funded by after-tax dollars. While these plans do not present the disadvantages of a tax deferred retirement plan, they share all the other characteristics and detriments of the traditional 401(k) plans, listed in this document.

#2. Legal Framework Risk

In additional to the risk of increased tax rates, there is also the risk of changed legislation. Given the long-term horizon of the 401(k) investments, there is no guarantee that the rules applicable today will still be valid five years down the road, let alone 20 or 30.

There is no evidence that politicians are changing the rules in the favor of the large population, and this is valid for politicians in any country, not only in the US. Since its creation, history shows, the 401(k) system, every year, is increasingly more complex, harder to understand and requires full time experts to navigate through it.

Do I have any reason to believe that, over time, the system will be simplified and easier to comprehend? Definitely not. As there are currently trillions of dollars in 401(k) savings accounts, do I have any reason to believe that the government will keep their hands off it? Or rather, should I think there’s a chance for those funds to be taken over ‘legally’ and replaced with IOUs (‘I Owe You’), like it happened to Social Security?

For me, this is too much of a risk to take, and this is the second reason I do not have a 401(k).

#3. Obligation to take distributions after a certain age

Let’s say that you reach the age of retirement, and you have a really nice 401(k) account, some hundreds of thousands or maybe over a million dollars, but you decide that you do not want to start tapping into that account. Maybe you prefer to continue working because you own a business that provides a nice yearly income; or maybe you have a certain expertise that is valuable and other companies may want to hire you as a part time consultant that also pays you a handsome amount. Or perhaps you have some other investments besides a 401(k) that provide you a good passive income – like real estate, or a nice dividend stocks portfolio.

At that age, your mortgage is paid (or at least should be), the nest is empty, you drive less and, generally speaking, you spend less on clothes and other necessities. Everything should be in place for you to make a decent living without tapping into your 401(k), allowing you to continue to let it grow, and maybe even leaving it to the kids as an inheritance.

Unfortunately, you cannot do that because the tax rules require that you begin withdrawing from your savings account, something called Required Minimum Distribution (RMD). These are calculated based on your age, life expectancy and the amount in your 401(k) account. If you do not take the RMD as the law demands, a stiff penalty is applied as an additional tax (currently 50%), a penalty applied on top of the regular income tax.

Add the RMD to your other forms of income, and take into account that you cannot enjoy the tax deductions you enjoyed during the working years, and then apply a regular income tax to that.

To me, that’s not a good deal, and that is the third reason I do not have a 401(k).

#4. Limited investment options

The 401(k) system is designed for passive investments in different forms of funds, mainly equities (stocks) and bonds. The idea behind it is that stocks investments are riskier, but offer higher returns, while bonds are safer, but provide lower returns.

Many funds are available, with different risk profiles – index, sector based, geographic, developed vs. emerging markets, etc. and sometimes these are combined with bond funds. Basically, the fund managers are offering programs depending upon a person’s age and expected number of years until retirement. The basic rule is that younger contributors to the 401(k) funds can take higher risks because they have time to go through the ups and downs of the markets; therefore, their portfolios contain a larger share of equities. As people get older, the priority becomes avoiding losses; therefore, the balance is tilted towards bond funds.

While this sounds reasonable, and it looks like there are many options available, the fundamental problems is all options belong to one category – ‘funds’, each fund consisting of many individual, but alike, components – be it treasuries, stocks, corporate bonds etc. The advantage, we are told, is that it reduces the risk because it eliminates exposure to individual stocks and debt instruments.

A 401(k) portfolio may look like a diversified portfolio, but it is surely not the case, because all assets are of the same nature. This is not a real diversification, and this is the fourth reason I do not participate in a 401(k) program.

#5. The mandate to be fully invested

The managers of 401(k) funds have a mandate to be fully, or almost 100% invested in the specific instruments of each particular fund. This constitutes a major problem in times when there is a significant risk for market decline.

Being in the hot spot of trading desks of the financial system, the fund managers have timely information about the conditions and even the direction of the markets. They may very well be aware that, at some point, a market crash may be imminent. In a moment like this, the logical decision is to sell assets and park the proceeds in cash to avoid losses. This is probably what they do to protect their private portfolios, and maybe advise some relatives and friends to do the same. But they cannot do the same for the 401(k) funds they manage, because the mandate requires them to be fully invested.

Practically, the 401(k) funds, like any index fund, provide no loss protection in case the market drops. The basic narrative is that, in the long run, it does not really matter because the ‘market comes back up again’. This may be true, but the question is – how long does it take before the market comes back?

The history shows us it takes a while, and here are the most known examples:

• After the crash of September 1929, the DJIA reached the same level in November 1954 – that was 25 years later.

• After the crash of December 1999, the DJIA came back at the same level in September 2006 – that was almost 7 years later.

• After the decline starting October 2007, it took almost 6 years for the DJIA to reach the same level, that was in February 2013.

(check data on https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart)

Being invested in 401(k) funds, allows for no possibility to sell high and buy low, even if the fund manager is fully aware that the downturn is imminent. The only option you have is to wait patiently for years hoping that the market will come back soon. I have no idea whether the markets will be at a peak or a trough at the time of my retirement, and I know that I will be forced to take distributions without being given the option to wait some years for the market to recover. Therefore, this is the fifth reason I do not have a 401(k).

#6. Ten percent down and ten percent up are not the same

Related to the previous point, we have to understand that a certain percentage drop in the value of an asset, followed by the same percentage increase, will not bring the value to the original level.

For instance, if a certain stock is valued at $100, a 20% drop will bring it down to $80. Further, if it increases 20%, it will reach a level of $96. In other words, 20% down followed by 20% up, leads to an overall loss of 4%.

In order to get to the same initial level, the increase will need to be 25% to lift it from $80 to $100.

The bigger the drop, the bigger the increase needs to be.

A 33% decrease, from $100 to $66.6, will require close to 50% increase to bring it back to the original level of $100.

A 50% drop, from $100 to $50, will require a 100% increase for the same.

In other words, it’s an easy way down and a hard way up… and this is the sixth reason why I do not have a 401(k).

#7. The value of the portfolio is not the same as ‘cash in the bank’

Another common misconception is that people have ‘money’ in their 401(k) accounts. The simple fact that certain values are expressed in monetary terms does make those values to be ‘money’.

Today, there are four type of assets that have monetary labels ($, EURO, GBP, CHF etc.) attached to them:

· Money – that is only gold and silver. In the US, the Constitution states the following: Article I, Section 10, Clause 1: ‘No State shall […] make any Thing but gold and silver Coin a Tender in Payment of Debts.’]. The Coinage Act of 1792, introduced the US Dollar as equivalent to a specific quantity of gold and silver.

· Currency – that is a medium of exchange declared to be valid for all payments, private or public, by decree of the government and issued by a Central Bank. Currencies are not backed by any form of material assets and this is the category the modern world of finances inappropriately defines as ‘money’, like $, Euro, GBP, CHF, etc.

· Credit – this is a form equivalent to currencies, created by commercial banks using the fractional reserve mechanism. This mechanism allows the banks to generate new currency by lending the most of their customers’ deposits to borrowers. The borrowed amount is spent into the economy and redeposited in the banks. The fractional reserve mechanism is also called ‘money multiplier’.

· Derivative financial products – this is the largest category of assets, including stocks, bonds, shares in any forms of investment funds, plus all sophisticated financial instruments with fancy names like mortgage-backed securities, collateralized debt obligations, credit default swaps and so on.

All four categories have values expressed in monetary terms, but we have to understand that ‘credit’ and ‘derivative financial products’ are not ‘money’, nor ‘currency’.

All 401(k) portfolios normally consist of equity (stocks) and/or bond funds. A fund is a combination of underlying assets, and the combined market value of those assets determines the value of the fund. So, when someone says ‘I have $10,000 in an equity fund’, the correct statement is ‘The market value of the equities in the fund I invested in is $10,000’.

In order for that amount to be transferred to ‘money’, it requires a sale of the shares of the fund to a buyer. Depending of the type of the fund, it may require sale of the underlying assets (equities, bonds). This is not a problem when there is a balance between sellers and buyers, but if for some reason many investors want to sell and there are not enough buyers, the evaluations come crashing down following simple offer vs. demand rules.

Regardless what your 401(k) account balance shows, the real value of those assets is determined in the moment they are sold and the transaction is completed, and you have currency in your bank account, currency available for your spending.

Because I understand the difference between ‘market value’ and ‘cash available’ and the risk of significant depreciation of financial assets in turbulent times, this is the seventh reason I do not have a 401(k).

#8. Fees

The 401(k) funds are required to be upfront with their Management Fees, and these are normally disclosed as ‘Expense Ratio’. This is a good thing, but there is no similar requirement for transparency related to any other fees required to operate the fund.

The management fees range between 0.75% and 2% of the funds’ capital. In addition to this fee, there are other costs to be paid by the fund: Administration Fees (applicable for assets added to and/or removed from the fund); Legal Fees (whenever legal advice and review is required); Regulatory / Filing Fees (for filing documentation to different regulatory authorities); Marketing Fees, etc. All these additional fees, that are normally disclosed with fine print in the Addendums of the Financial Reports, increase significantly the percentage that is syphoned away from the funds.

As long as these fees are not disclosed beforehand, it is very hard to opt for one or another fund basing that decision on the management fee alone. It is like, let’s say, an owner of a restaurant, who has to hire a manager and focuses solely on the manager’s salary, without questioning the applicant’s ability to control operational costs. The restaurant owner may be happy to save a few thousands a year choosing a candidate that accepts a lower payment, but he may lose multiple times that amount if that candidate doesn’t properly control costs – raw material, utilities, consumables, or is not focused on providing good service, leading to losing customers.

For the sake of exercise, let us see what is the impact of the fees for a 30-year plan where someone makes yearly contributions of $3,000. We will base our calculations on a 7% yearly return and two levels of fees, 2% and 3%. Results are shown in Chart 1:

· The green line shows the Value of the Account after 30 years, assuming a 7% yearly return and no fees. This value is $306,219.

· The orange line shows the Value of the Account after 30 years, assuming a 5% yearly return (7% return minus 2% fees). This value is $212,282.

· The red line shows the Value of the Account after 30 years, assuming a 4% yearly return (7% return minus 3% fees). This value is $177,985.

Chart 1

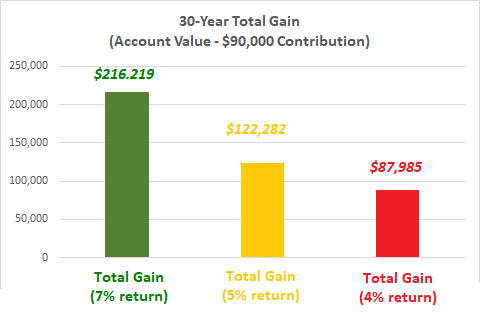

If we compare the 30-year Total Gain (the Account Value minus the total contribution of $90,000, representing $3,000 yearly over 30 years) and use the same assumptions, the results are shown in Chart 2:

· The green bar shows the Total Gain after 30 years, assuming a 7% yearly return and no fees. The Total Gain is $216,219.

· The orange bar shows the Total Gain after 30 years, assuming a 5% yearly return (7% return minus 2% fees). The Total Gain is $122,282.

· The red bar shows the Total Gain after 30 years, assuming a 4% yearly return (7% return minus 3% fees). The Total Gain is $87,985.

Chart 2

Regardless of how you calculate it, you give away somewhere between a third and a half of all gains to someone who does nothing but keeps an eye on passive investment vehicles and write mumbo-jumbo reports that mere mortals have absolutely no chance of understanding. Giving away between a third and a half of the gains is not something I am willing to do, and this is the eight reason why I do not have a 401(k).

#9. Employer contribution is NOT free money

One of the most common misunderstandings, caused also by an aggressive promotion by the Human Resources (HR) representatives, is the Employer Match program, where the employer matches a percentage of the employee’s contributions, and thus the employee benefits of ‘free’ money.

The HR representatives are not to blame or accused of ulterior motives, because in most cases they believe themselves that employer contributions represent ‘free money’ for the employee.

How does this work? If an employee decides to contribute with, let’s say, $3,000 per year to his 401(k) account, the company will add another $3,000 per year to the same account, raising the total yearly contribution to $6,000. What can be better than $3,000 for free, right?

Well, if we look behind the curtain, we will understand that this is not the case. In the operational budget of any company, big or small, there is a section dedicated to ‘Employees’. This is part of the Expense budget, or Operational Costs, and it covers not only gross salaries, but all kind of costs associated to those employees – employer taxes, all type of insurances, tuition support, protection equipment, travel expenses, mileage refunds, work related equipment and devices like computers, phones and so on… Matching 401(k) contributions are part of this budget cost and are already baked in the overall Profit & Loss Statement of each corporation.

But the company managers say: ‘We allocated X amount of money for you as a matching contribution to your 401(k), but you are not going to get it. We are giving it to our buddies on Wall Street, so they can write nice reviews about our corporation; in this way, the stock price will continue to go up and we will be able to cash-in our hefty bonuses at the end of the fiscal year. But this is not all; we want you to give as well to our buddies on Wall Street the same X amount of money, so they have more to play with. And if you do not agree to give them your share of the contribution, you are getting nothing. Our matching contribution will remain in the company, adding positively to the bottom line, increasing profits and raising stock price, so we can get out hefty bonuses regardless.’

According to The Merriam-Webster Dictionary, ‘free’ is something that is ‘not costing or charging anything’. As long as the matching contributions are already included in the HR budgets but are not given to the employees directly and unconditionally (the condition being that employees must accept to give away a share of their net salary), they do not represent ‘free money’. And this is the ninth reason why I do not have a 401(k).

#10. Limited early withdrawal options

Let us assume that, after diligently making significant contributions for a number of years, your 401(k) shows a nice balance of $200,000. You may think this is a good time to take some money out for a very specific and legitimate purpose – you may want to make a down-payment for a rental property, or want to pay off your mortgage or, knock on wood, you suddenly face a health issue that requires a treatment not covered by your insurance.

If you try to do that, you’ll will find out that this is easier said than done. Any early distribution from a 401(k) plan (that is before age of 59 ½ years) is penalized with 10% of the withdrawn amount. In addition, the full amount is added to your regular income for tax calculation, increasing significantly the chance to place you in a higher tax bracket. A quick check with an accountant or a tax advisor will show that, after penalties and taxes, all you can count on is 50-60% of the withdrawn amount, the balance of 40-50% going to penalties and taxes.

In addition to penalties and taxes, many 401(k) plans have very strong limitations on the amount that can be taken out, capping it to a few thousand dollars every year.

Because I do not want to contemplate an untouchable account balance of hundreds of thousands of dollars while I may need the money for other investments or emergencies, this is the tenth reason why I do not have a 401(k) plan.

Conclusions

The question is – if I do not have a 401(k) but I still believe in planning and investing for retirement, what is my strategy?

In short, I am focusing on two types of assets:

a) For protection, I choose assets that proved over decades (even centuries) that they offer purchasing power stability during both boom-and-bust cycles, during both inflationary and deflationary seasons. In addition, these assets have to be liquid and always in demand.

A portfolio built around precious metals and certain commodities (including mining companies) meet these criteria.

b) For continuous growing income, I choose cash-flow generating assets. Such assets are real estate and carefully selected dividend paying stocks. Saying ‘carefully selected’, means stocks of companies that sell real goods and services, satisfying basic necessities for real people.

And, when it comes to taxes, I pay to Uncle Sam every year what belongs to Uncle Sam. Whatever is left, is mine. I use a tax advisor who keeps track of the changes in the Tax Code, and when rules are changed, I deal with them as they are implemented, without worrying whether my decision to defer taxes was a good or a bad one.

More to come about these strategies in a future blog post.

Comments